Discover the top fintech app development services: vetted providers, costs, timelines, compliance, and must-have features. Compare options and pick a partner.

Fintech app development services are specialized offerings from agencies that design, build, and launch financial technology applications. In a world where digital payments are projected to reach over $11.55 trillion, these services are a necessity for startups aiming to innovate in finance. From mobile banking and investment platforms to payment gateways and insurance tools, finding the right partner to build your vision is the first step toward success. The global fintech market is expected to grow significantly, reaching over $644 billion by 2029, making it a critical time for founders to enter the market with a strong, viable product.

Why Fintech is Booming: Market Trends and Drivers

The financial technology sector is experiencing explosive growth, driven by a perfect storm of technological advancement and shifting consumer expectations. After the pandemic, use of fintech apps surged, with a 72% increase in Europe alone, as consumers moved away from traditional banking. Today, technology isn’t just a part of finance, it is finance.

Key drivers shaping the need for fintech app development services include:

Massive Market Growth: The global fintech market was valued at approximately $209.7 billion and is projected to grow at a compound annual rate of over 25%. This rapid expansion creates immense opportunities for new and innovative solutions.

Customer Expectations: Modern consumers are accustomed to seamless digital experiences and demand the same from their financial providers. They expect tailored offers, instant transactions, and user friendly interfaces, pushing founders to deliver high quality applications quickly.

Technological Advancements: The rise of AI, machine learning, and blockchain technology allows for more sophisticated and secure financial products. The AI in fintech market alone is valued at $30 billion in 2025 and is expected to nearly triple by 2030.

Embedded Finance: Financial services are increasingly being integrated into non financial platforms, like SaaS tools and e commerce sites. This trend is powered by APIs and creates new revenue streams and user experiences.

Exploring Key Fintech Application Models

The fintech landscape is diverse, with innovators building solutions for nearly every financial niche. Understanding these models can help you identify opportunities and define your product’s focus.

Peer to Peer (P2P) Lending and Loan Management

P2P lending platform development connects borrowers directly with investors, cutting out traditional financial intermediaries. These apps require robust systems for credit scoring, payment processing, and loan management. A well built loan management app provides transparent dashboards for both parties, automating repayments and managing defaults, which is crucial for building trust.

Personal Finance and Budgeting Apps

Finance management app development is booming as consumers seek better ways to track spending, save money, and plan for the future. These apps often use API integrations to aggregate data from multiple bank accounts, providing users with a holistic view of their financial health. Success hinges on a simple, intuitive user experience that makes budgeting feel effortless.

Mobile Point of Sale (mPOS) Systems

A mobile point of sale system transforms a smartphone or tablet into a cash register. This technology is essential for small businesses, freelancers, and merchants on the go. Development focuses on secure payment processing (NFC, QR codes, card readers), inventory management, and sales analytics, all wrapped in a portable and easy to use application.

Financial Service Marketplaces

Financial service marketplace development creates platforms where users can compare and purchase products like insurance, mortgages, or investment funds. These applications act as aggregators, requiring sophisticated API integrations with multiple financial institutions to provide real time quotes and a seamless application process.

KYC and Identity Verification Platforms

Know Your Customer (KYC) platform development is a critical component of RegTech (Regulatory Technology). These services help other fintech companies verify user identities to comply with Anti Money Laundering (AML) regulations. They leverage AI for document scanning and biometric analysis, creating a secure and streamlined onboarding experience.

Top 10 Fintech App Development Services

Now that you have a solid understanding of the essential features and considerations for building a fintech application, it’s time to explore the teams that can turn your vision into reality. This section highlights the top 10 providers of fintech app development services that have been selected based on their proven expertise, innovative solutions, and successful track record in the complex financial landscape. These firms are known for delivering secure, scalable, and user centric applications for a diverse range of clients, from startups to established financial institutions.

1. Bricks Tech is a startup native product studio that moves fast without breaking the future. They blend no code speed with full stack discipline to help founders validate payment enabled ideas (marketplaces, donations, SaaS billing) and keep a clean path to scale on modern cloud.

Fast facts: Startup first; rapid fintech MVPs

Team: 15+ core specialists

Locations/markets: Toronto, Lahore, Singapore

Compliance posture: Secure by default on AWS/Supabase

Notable clients: WNTAD, NeighborGood, BestCustodyCase

Core domains: Payment marketplaces, SaaS billing, donation platforms

Typical project size/timeline: MVPs from $10k in 4 to 8 weeks

How they build for founders: Bricks pairs Bubble with Supabase/Postgres and full stack engineering to ship investor ready MVPs quickly, then harden into scalable services. API first by default, they plug in Stripe, KYC/AML vendors, and AI/ML features, with role based access and secure flows running on AWS.

2. Itexus is a compliance first fintech builder trusted by banks, lenders, and high growth startups. From neobanks and wallets to trading and lending, they ship regulated apps that scale and pass audits.

Fast facts: 12+ years in fintech

Team: 150+ engineers

Locations/markets: U.S. & EU; North America, Western Europe, Gulf

Certifications/compliance: PCI DSS aligned, KYC/AML, GDPR/CCPA

Notable clients: Coinstar, Top 7 U.S. Credit Union; 4.9/5 on Clutch

Core domains: Digital banking, payments, wallets, trading, lending, crypto

Typical project size/timeline: $50k+; MVPs in 3 to 4 months

How they build for founders: Itexus delivers native iOS/Android and web apps on AWS/Azure with event driven microservices. API first integrations span Plaid, Stripe, Sumsub, and more. Security is woven in (encryption, MFA, access controls) so products align to PCI DSS and privacy regulations from day one.

Proof + best fit: A Top 7 U.S. credit union cut onboarding from 5 days to 15 minutes; Coinstar’s crypto wallet ecosystem ships under strict compliance. Ideal for seed to Series C founders who need audit ready builds. Engagements: full cycle, dedicated squads, or staff aug; typical MVP in 3 to 4 months.

3. KindGeek is a product minded fintech partner known for elegant UX backed by bank grade plumbing. Whether you need a neobank, wallet, or payments layer, they bring a security by design mindset to every sprint.

Fast facts: 10 years in fintech

Team: 200+ specialists

Locations/markets: Ukraine (HQ), UK; serves EU/US

Certifications/compliance: ISO 27001, ISO 9001; GDPR/PSD2/SCA ready

Notable clients: Jaja Finance, payabl., HyperJar; Clutch Global Award 2023

Core domains: Neobanking, payments, wallets, money transfer, open banking

Typical project size: $50k+ minimum engagement

How they build for founders: KindGeek offers a customizable, API first core to jumpstart delivery or builds greenfield from scratch. They integrate with rails and open banking partners like Salt Edge, combine Python back ends with cloud native infra, and harden KYC/AML and SCA from the outset.

Proof + best fit: Delivered a core banking MVP for payabl. in ~7.5 months and powered HyperJar with an 18 person squad. A strong fit for pre seed to Series B fintechs needing speed plus compliance. Models: full cycle builds, dedicated squads, or staff aug.

4. UppLabs is a fintech first engineering team for founders who need compliant payments, banking, or trading products fast. They emphasize API first builds, modern clouds, and measurable reliability.

Fast facts: 11+ years in fintech

Team: 100+ fintech engineers

Locations/markets: US, EU (R&D in Ukraine)

Certifications/compliance: PCI DSS, PSD2, GDPR, KYC/AML

Notable clients: Tax1099, Tenurex, Relay Payments

Core domains: Payments, digital banking, lending, trading

Typical project size/timeline: $25k+; MVPs in 8 to 12 weeks

How they build for founders: Native and cross platform apps (iOS/Android, React Native) with .NET/Node/Python back ends, containerized and orchestrated for scale. Security is standard (AES 256, OAuth2, and ML powered fraud prevention) to match PCI/PSD2/GDPR requirements.

Proof + best fit: A digital gateway processed $2.5M in six months at 99.9% uptime and passed PCI on first audit. Ideal for seed to Series B fintechs needing compliance aware execution. Engagements: full cycle, dedicated squads, or staff augmentation.

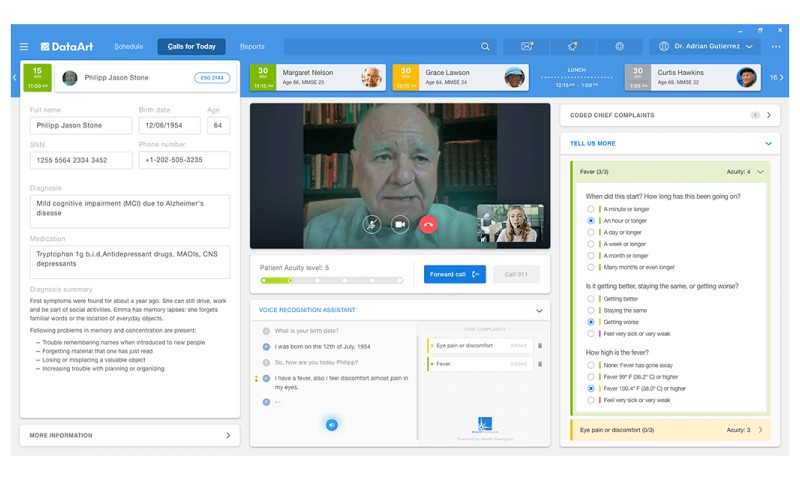

5. DataArt brings enterprise grade engineering to ambitious fintechs. From digital banking to capital markets, they build resilient, real time systems that stand up to scale and regulation.

Fast facts: 27+ years in fintech

Team: 6,000+ engineers

Locations/markets: U.S., U.K./EU, LatAm, India, Middle East

Certifications/compliance: SOC 2 Type II, ISO 9001; aligned to PCI DSS & GDPR

Notable clients: Nasdaq, Invesco; Inc. 5000 (13x)

Core domains: Payments, digital banking, capital markets, insurance

Typical project size/timeline: $100k+; MVPs in 1 to 3 months

How they build for founders: Cloud native, API first systems on AWS/Azure/GCP, with microservices, event streaming, and real time data. Deep experience with Stripe/Adyen and tokenization to minimize compliance scope.

Proof + best fit: For GroundScope, a Stripe based platform cut operating costs by 80%; Ledgebrook saw an MGA MVP in under four months. Best for seed to Series C teams needing enterprise rigor. Models: full cycle, dedicated squads, or staff aug.

6. ELEKS marries enterprise security with startup tempo. Their teams prototype in days, validate fast, and harden fintech products for production across banking, payments, and investment tech.

Fast facts: 15+ years in fintech

Team: 2,100+ professionals

Locations/markets: US, Canada, UK, EU, MENA, Japan

Certifications/compliance: ISO 27001:2022, SOC 2 Type II, HITRUST e1; PCI DSS ready

Notable clients: Eagle Investment Systems (BNY Mellon); IAOP Global Outsourcing 100

Core domains: Investment management, B2B payments, mobile apps, regtech

Typical project size/timeline: Starts at $25k; prototypes in 3 to 5 days

How they build for founders: API first architectures on AWS/Azure, integrating payment gateways and KYC vendors; React Native plus .NET/Java back ends. Security and compliance are foundational, with certified programs and PCI ready designs.

Proof + best fit: A 15 year partnership with BNY Mellon’s Eagle proves scale; Civex went from concept to launch in eight months. Best for venture backed fintechs wanting enterprise grade security with rapid validation. Engagements: full cycle builds and dedicated squads.

7. Tech Alchemy is a product studio for modern fintech and Web3. They excel at melding compliant payments, identity, and digital asset tooling into polished, investor ready apps.

Fast facts: 9+ years in fintech

Team: 200+ designers & engineers

Locations/markets: London (HQ); UK/EU, US, MENA

Certifications/compliance: GDPR aligned; integrates with regulated vendors

Notable clients: 3S Money, Mercore; Clutch Premier Verified (5.0/5)

Core domains: Payments, wallets, KYC, crypto, DeFi

Typical project size/timeline: $50k to $199k

How they build for founders: API first integrations with Currencycloud, PayPal, Fireblocks, and LexisNexis speed delivery while keeping compliance tight. They run micro scope (1 to 2 weeks) or deeper discovery (6 to 8 weeks) then execute in two week sprints using native and React Native stacks.

Proof + best fit: For 3S Money, they automated KYC flows; a Web3 platform they built attracted 1.5M+ visitors in month one. Ideal for pre seed to Series B startups needing a fast, scalable MVP. Engagements from $50k to $200k.

8. Nimble AppGenie builds eWallets, mobile banking, and payment apps that go live quickly and stay compliant. Expect solid UX, strong rails integrations, and disciplined security.

Fast facts: 8+ years in fintech

Team: 51 to 200 employees

Locations/markets: US, UK/EU, MENA, APAC

Certifications/compliance: ISO 27001; builds for PCI DSS, GDPR, SOC 2

Notable clients: Pay By Check, CUT, DafriBank

Core domains: eWallets, mobile banking, payments, lending

Typical project size/timeline: MVPs from 3 months (~$50k+)

How they build for founders: Native (iOS/Android) and Flutter apps with KYC onboarding, ACH/EFT, QR/NFC, and multi currency. API first integrations with Stripe/Adyen and open banking; Node.js back ends on AWS/Azure/GCP with MFA, biometrics, and AES 256 baked in.

Proof + best fit: Pay By Check and CUT launched in ~3 months each across multiple regions. Best for pre seed to Series B founders and SMBs targeting a 10 to 14 week payment MVP. Models: full cycle, dedicated squads, or staff augmentation.

9. SDK.finance is a modular fintech core that lets teams ship a wallet or neobank in weeks, then scale with full source code control when the stakes rise. It’s speed now, sovereignty later.

Fast facts: 12+ years (founded 2013)

Team: 40+ members

Locations/markets: EU, UK; Europe, MENA, Africa

Certifications/compliance: PCI DSS Level 1, ISO 27001, GDPR aligned

Notable clients: Geidea, MPAY; PayTech Awards 2025 finalist

Core domains: Digital wallets, neobanking, payment processing

Typical project size/timeline: SaaS in weeks; source code in months

How they build for founders: An API first platform (470+ REST APIs) with a robust ledger, Java/Spring core, Kafka, and Kubernetes for high throughput. Pre integrations cover KYC (Sumsub), AML (ComplyAdvantage), issuing (Marqeta), and gateways (MPGS, Cybersource). Choose SaaS for speed or source code to avoid lock in.

Proof + best fit: Geidea modernized its ledger for merchant settlement; a Central Asian government launched a PCI DSS compliant benefits card in six months. Best for venture backed startups and established FIs. Engagements: full cycle builds or source code license.

10. Innowise ships finance grade apps (banking, wallets, lending, and digital assets) with the compliance muscle and cloud scale founders need from MVP to V1 and beyond.

Fast facts: 18+ years in fintech

Team: 3,000+ IT professionals

Locations/markets: US, EU, UK, UAE

Certifications/compliance: ISO 27001/9001; PSD2, GDPR, PCI DSS/SOC 2 readiness

Awards: Inc. 5000; IAOP Global Outsourcing 100

Core domains: Payments, banking, lending, wallets, crypto

Typical project timeline: MVP in 2 to 3 months

How they build for founders: API first integrations with Stripe, Mambu, and Sumsub; native and cross platform clients on AWS/Azure/GCP; microservices plus AI/ML for fraud and credit scoring. Privacy and payment standards are built in to speed audits.

Proof + best fit: Delivered an asset tokenization platform that expanded investor access 10x while cutting costs ~80%. Ideal for seed to Series B fintechs and mid market FIs. Engagements: full cycle delivery, dedicated squads, or staff aug; MVPs in 2 to 3 months.

Scoping Your Fintech App: Must Have vs. Nice to Have Features

One of the biggest challenges for founders is defining the scope of their Minimum Viable Product (MVP). Trying to build everything at once is a common reason startups fail. A focused MVP validates your core idea with real users before you invest heavily in complex features.

Core Features for Your MVP

An MVP isn’t about being minimal, it’s about being viable. For a fintech app, viability means being secure, compliant, and solving one core problem exceptionally well.

Secure User Onboarding: This includes user registration, secure login with multi factor authentication (MFA), and a streamlined Know Your Customer (KYC) process to verify identities.

Bank and Card Integration: Users need to connect their financial accounts. Integrating with APIs from services like Plaid or Stripe is essential for fetching balances and enabling transactions.

A Single Core Function: Focus on the one thing your app does best. Whether it’s sending money, tracking expenses, or viewing a portfolio, this core operation must be flawless.

Transaction History and Dashboards: Users need a clear and simple way to view their financial activity. Transparency builds trust, which is a non negotiable in finance.

Advanced Features for Scale

Once your MVP gains traction and you’ve gathered user feedback, you can begin adding more advanced functionality.

AI Powered Recommendations: Use agentic AI and machine learning to offer personalized financial advice, budget tips, or investment insights.

Data Analytics and Insights: Provide users with advanced visualizations and reports on their spending habits, investment performance, or business revenue to deliver greater value.

Biometric Security: Enhance security and user experience with fingerprint or facial recognition logins.

Multi Currency Support: Essential for apps targeting international users or dealing with cross border payments.

Automated Chatbots: Provide instant customer support and answer common questions without human intervention.

How to Choose the Right Fintech App Development Partner

Selecting the right partner is arguably more important than the technology you choose. The right team doesn’t just write code, they act as a strategic partner, challenging your assumptions and guiding you toward a successful launch. For early stage startups, founder friendly agencies like Bricks Tech can provide the necessary expertise to build an MVP quickly and affordably.

Look for a partner with:

Proven Fintech Experience: They should have a portfolio of successful fintech applications and a deep understanding of the industry’s security and regulatory challenges.

A Transparent, Agile Process: A clear development process with weekly demos and check ins ensures alignment and prevents costly rework. This approach keeps you in control of the project’s direction and budget.

Understanding Engagement Models and Development Processes

Fintech app development services typically offer a few common engagement models, each suited for different needs and stages.

Build From Scratch (Fixed Scope): Ideal for MVPs with a clearly defined feature set. This model offers predictable costs and timelines. For instance, Bricks Tech’s popular package builds a fully functional app in 8 weeks for a fixed price, with a refundable first week to ensure a good fit.

Flexible Retainer (Your Team): This model provides a dedicated team of project managers, designers, and developers for a monthly fee. It’s perfect for startups that need ongoing development, feature enhancements, and the ability to scale resources up or down as needed.

Maintenance Plan: After launch, your app needs continuous support. A maintenance plan ensures security updates, bug fixes, and performance optimizations are handled proactively, often with a guaranteed response time.

Navigating Security and Compliance in Fintech

In fintech, security and compliance are not features, they are the foundation. A data breach doesn’t just cause reputational damage, it can lead to massive fines and completely destroy user trust. Your development partner must have a deep understanding of the regulatory landscape.

Key regulations and standards to be aware of include:

PCI DSS (Payment Card Industry Data Security Standard): Required for any app that handles credit card information.

GDPR (General Data Protection Regulation): Applies to any app that serves users in the European Union and governs how personal data is handled.

KYC and AML (Know Your Customer and Anti Money Laundering): Regulations that require you to verify user identities to prevent financial crimes.

A trustworthy fintech app development service builds security in from day one, using data encryption, secure APIs, and regular penetration testing to protect sensitive information. For applications requiring the highest level of integrity and transparency, blockchain based transaction security offers a decentralized, immutable ledger. This can be a powerful differentiator for certain use cases, though it adds complexity to the development process.

Building a Connected Ecosystem: APIs and Architecture

Common API integrations in fintech include:

Payment Gateways: Stripe, PayPal, Adyen

Bank Account Aggregation: Plaid, Yodlee

Identity Verification: Onfido, Jumio

Market Data: Xignite, Alpha Vantage

Data and Analytics: APIs can also be used to pull data into analytics platforms, helping you monitor app performance, track user behavior, and make data driven decisions for future development.

Choosing a partner with experience integrating dozens of APIs is crucial for building a feature rich application. A modern, API first architecture allows for faster development, greater flexibility, and the ability to seamlessly add new services as your product evolves.

Budgeting and Timelines for Your Fintech MVP

One of the first questions every founder asks is, “How much will it cost and how long will it take?” While costs can range from $30,000 to over $150,000 depending on complexity, the goal of an MVP is to validate your idea efficiently. Building a full featured product can take over six months and cost well over $150,000.

A focused fintech MVP, however, can be built much faster and more affordably. Development agencies specializing in no code and low code technologies can often deliver an MVP in 4 to 8 weeks. For example, productized services offering an 8 week build for around $10,000 provide a clear, predictable path to market for early stage founders. This approach allows you to launch quickly, gather real world feedback, and demonstrate traction to investors without breaking the bank. Find out if your project is a good fit by scheduling a free consultation.

Making the Final Decision for Your Fintech Project

Choosing from the many fintech app development services available can feel overwhelming. To make the right choice, focus on the partner, not just the price tag.

Ask yourself these final questions:

Do they think like a founder and prioritize business outcomes over billable hours?

Is their communication process clear and collaborative, with regular demos and feedback loops?

Do they offer post launch support to ensure your app remains secure and performant?

Can they scale with you as your needs evolve from a simple MVP to a full featured product?

The right partner will act as an extension of your team, providing strategic guidance and technical excellence every step of the way.

Launching Your Vision with the Right Development Services

Bringing a fintech app to life is a complex but rewarding journey. The market is growing rapidly, but so are the challenges of security, compliance, and user trust. The key to success lies in choosing a development partner who understands this landscape and can help you navigate it efficiently. The right fintech app development services empower you to launch faster, mitigate risk, and build a product that users love and trust.

Ready to turn your fintech idea into a reality? Explore how Bricks Tech builds scalable, secure apps in weeks, not years.

Frequently Asked Questions About Fintech App Development Services

What is the average cost of fintech app development services?

The cost varies widely based on complexity. A Minimum Viable Product (MVP) can range from $25,000 to $80,000. More advanced applications with complex features can cost $150,000 or more. Some agencies offer productized packages for MVPs around $10,000.

How long does it take to build a fintech app?

A typical fintech MVP can be developed in 2 to 6 months. Using rapid development approaches like no code or low code, this timeline can often be shortened to 4 to 8 weeks, which is ideal for startups needing to validate their ideas quickly.

Is no code a good option for fintech apps?

Yes, when paired with a robust backend. Platforms like Bubble.io are excellent for building the user interface and application logic quickly. For security and scalability, they are often connected to powerful backends like Supabase or AWS, ensuring that the app is both secure and capable of handling growth.

What are the most important security features for a fintech app?

Key security features include end to end data encryption, multi factor authentication (MFA), biometric login options, secure API gateways, and compliance with standards like PCI DSS and GDPR. Regular security audits and penetration testing are also essential.

What kind of post launch support will I need?

After launching your app, you will need ongoing maintenance to manage security updates, fix bugs, monitor performance, and make feature enhancements based on user feedback. Many agencies offer monthly maintenance plans with guaranteed response times to keep your application running smoothly.